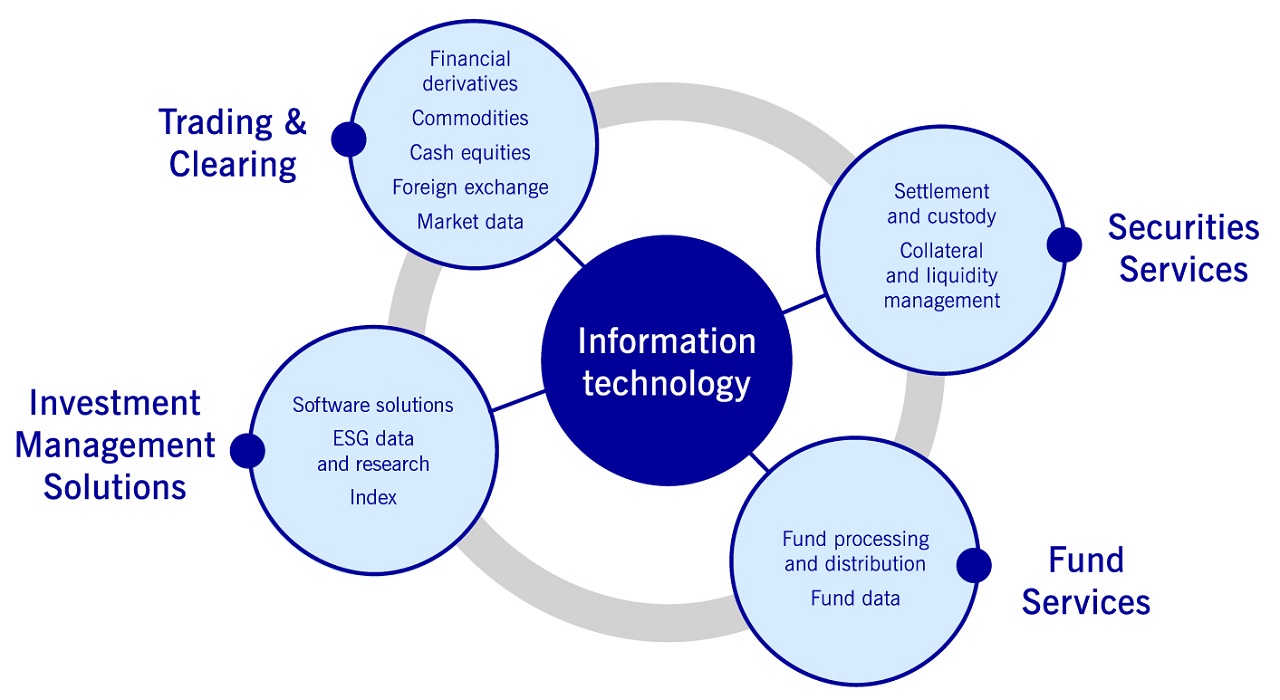

Trading and clearing of investment instruments are at the heart of capital market activities. We organize and operate regulated markets for securities, derivatives, commodities, currencies and other asset classes. To reduce default risk for buyers and sellers alike, fulfilment of closed transactions is ensured by our clearing houses. Through the acquisition of a majority stake in Crypto Finance we laid the foundation for building an independent, transparent and highly scalable ecosystem for digital assets under European regulation.

Financial derivatives

The Eurex derivatives exchange is one of the world’s largest markets for trading financial derivatives. It offers a wide range of international benchmark products such as interest derivatives and equity derivatives.

Commodities

EEX Group offers its participants a market platform for energy and commodities products in more than 30 countries around the world. Its product portfolio comprises power, gas, environmental, freight and agricultural contracts.

Cash equities

We operate the Frankfurter Wertpapierbörse (FWB®, the Frankfurt Stock Exchange). Besides specialist trading at Börse Frankfurt, it also operates the trading platform Deutsche Börse Xetra – the global reference market for German equities and the number one in Europe for exchange-traded funds (ETF).

We also offer a variety of segments and transparency standards for the admission and listing of securities of large companies and SMEs. Pre-market initiatives complete the range of these services, enabling us to make a significant contribution to financing the real economy and to promoting innovation in Germany and Europe.

Foreign exchange

Our subsidiary 360T is a leading global provider of web-based trading technology, which enables our customers to trade over-the-counter (OTC) financial instruments, particularly foreign exchange and short-term money market products, as well as foreign exchange and interest rate derivatives.

Market data

Our business unit Market Data + Services provides market participants around the world with proprietary market data from our trading platforms Xetra® and Eurex, as well as with data from its cooperation partners such as 360T, KAIKO, Santiago Stock Exchange, Mexican Stock Exchange or TAIFIEX. With high-quality, reliable information we enable our customers to make investment and trading decisions, manage risk, safeguard assets and meet increasing regulatory requirements.