Service Navigation

The detective at the stock exchange

23 Jan 2020

The detective at the stock exchange

Andreas Mitschke

Since January 2020, Andreas Mitschke is heading the Trading Surveillance Office of Eurex and Kassamarkt, or TSO for short. He is a true TSO veteran – with an investigative streak. He has been with the company for almost 20 years, and even after all this time, it is still the most exciting job he can imagine: “The speed, the algorithms, the regulations – there's always something new,” he explains. But: let’s start at the beginning.

It didn't take Andreas Mitschke long during his training as a banker to realise that his heart beats more for securities than for loans. So, the native Hanoverian went his own way in this area, advising wealthy private customers and continually educating himself further. In 2000, the TSO called.

Action instead of reaction

His first task: to monitor trading on Eurex as an analyst. “Even then, we received electronic alerts through an in-house system, but we also responded to complaints from market participants.” The fact that things are fundamentally different today is something that Andreas Mitschke also contributed to. He specialised in further advancing the surveillance technologically and played a key role in merging the trading monitoring of Xetra and Eurex due to the similar market models.

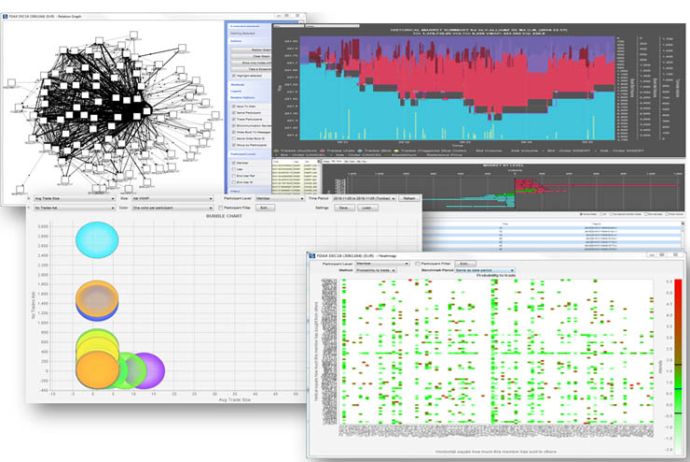

TSO implemented the change technically with the Scila system. Since 2012, it has been reporting abnormalities in the behaviour of trading participants on both stock exchanges and enables in-depth analyses, e.g. by visualising trading activities. Two to three billion transactions rush through Scila every day. “We are now working more proactively and are investigating whether these anomalies are due to manipulation, insider trading or breaches of regulations, for example. And the number of outside clues has dropped as a result.”

In his new role as head of the TSO, the 47-year-old wants to reverse the functional merger of the supervision of Xetra and Eurex without losing sight of possible forms of manipulation across markets.

At TSO Scila is a core tool.

AI for the “criminal investigators”

One of Andreas Mitschke's job goals is to further improve the quality of surveillance. To achieve this, he wants to use the opportunities offered by artificial intelligence (AI), machine learning and big data even more intensively in the future: “If we categorise an alert in Scila as a valid or false alarm, an AI module is already learning from it today. In the case of future alerts, it shows us how likely it is that it is justified or not. The goal is to avoid false alarms in the future.” Andreas Mitschke also plans to use AI to examine the existing data sets for anomalies. Are there certain patterns? Does a trader or an algorithm behave conspicuously?

AI or not: when looking into the future, the head of TSO continues to see people working in the TSO: “As soon as trading participants slightly change their behaviour, the AI must be able to detect this. Within a defined range, it can do so, but it is blind to larger changes. He also wants to “revive” the classic evaluation of statistics. The motto is: “follow the money”. Because if a trading participant rarely makes losses, this increases the probability of a manipulative approach. That sounds like detective work. “You need an investigative streak to work at the TSO, the motivation to want to find something. I sometimes describe us as the criminal investigators at the exchange.”