Market data

Market data – relevance for the financial market and the economy How they are generated and used

But what exactly are market data, how are they created, why are they important and for whom?

What are market data?

The definition of market data is provided by a single legal framework in the EU: trading venues such as stock exchanges continuously publish current bid and ask prices for financial instruments during their trading hours and indicate how many units are available at these prices on their trading venue (pre-trading data). After a trade has been concluded, the executed price, the volume and the time of the trade are also published (post-trading data).

How market data are generated – the process

Market data are generated by means of an elaborate process that is organised, operated and monitored by exchanges. One of the core functions of stock exchanges is organised and transparent pricing.

Regulated markets offer an attractive, secure and liquid trading environment in which fairness and transparency are paramount. Exchange trading and exchange data are two sides of the same coin. Trading and data are created on the same technical infrastructure: the exchange’s trading system. Market data is thus generated as a so-called “joint product” and cannot be separated from a trade’s execution. This is because every trade contains information such as the price, time and volume of the transaction. There’s no data without trading – and no trading without data. Many other markets, from bitcoin to used cars, have no comparable structures and are thus generally much less transparent and fair.

Stock exchanges continuously invest in reliable, efficient and monitored trading systems. This ensures that trading participants are not disadvantaged, manipulation of prices is prevented and technical errors can be discovered and corrected. Regulated trading in turn generates reliable, high-quality data. The value of market data lies in the trust placed in their quality and, more precisely, in the transparency, fairness and integrity with which they are generated on an exchange. At the same time, this trust is the basis for the comprehensive role they play in the economy.

Copyright: Deutsche Börse AG

The value of reliable data

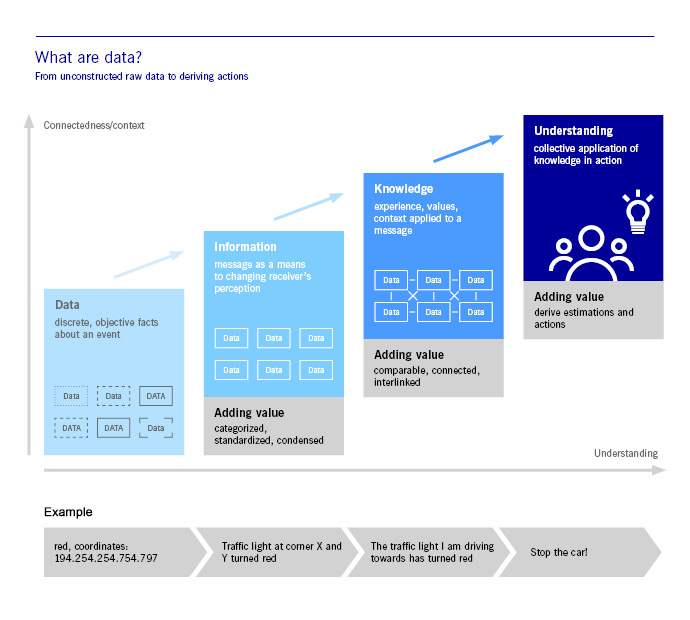

When you put individual data points together, you get information; combined with evaluations, economic interests and experience, this leads to knowledge. Knowledge, on the other hand, enables us to not have to guess when making decisions, but to give reasons why we are making a certain choice or not. The usefulness of the data keeps increasing: from the mere collection of data to the processing of useful information to strategic trading decisions. But decisions can only be made on the basis of reliable and correct data.

Stock exchanges cannnot function without market data. Everyone uses data – whether it’s for exchange trading, finding out the value of securities in a portfolio, or monitoring if everyone is following the rules. Financial markets only work when there is reliable and transparent information. Data quality is one factor that determines the trust placed in the decisions we make.

Who uses market data?

Stock exchange data are used extensively and by different customer groups such as trading participants, investors, index providers and competitors.

Market data generated on exchanges support and boost functioning trading, competition and job creation. Below you can find a selection from among their various uses with corresponding background information:

A large number of trading venues ensures competition

Market data generated on exchanges are an essential part of a long value chain and used for new business models, sometimes directly, sometimes indirectly: this includes alternative trading venues (which do not have their own pricing process, but rather use exchange prices as a reference), index providers, vendors and risk model providers, who benefit from this valuable data. Thus, market data do not only lead to more transparency but also to product innovation, more competition and choice for market participants.

Single European legal framework

Market data and its generation and publication by stock exchanges are subject to a legal framework and oversight by supervisory authorities. This is regulated uniformly in the EU in accordance with the European financial market regulation MiFID II/MiFIR.

A key objective of these regulations is to promote transparency of the financial markets and competition. Stock exchanges therefore play an important role in the pricing process and thus for the proper functioning of the market.

Market data services of Deutsche Börse Group

This is our offering:

- Highly granular real-time and delayed market data

- Historical data and a variety of meaningful analytics based on the proprietary data from Eurex, Xetra, 360T and Clearstream in our Deutsche Börse Data Shop

- Our cloud based A7 Analytics platform covering historical market data from CME Group as well as historical and intraday data from Eurex, Xetra and EEX

- Market data from our cooperation partners such as 360T, Santiago Stock Exchange, Mexico Stock Exchange and Pakistan Stock Exchange

- Aggregated real-time crypto data powered by Kaiko distributed 24/7 through our Deutsche Börse Cloud Stream

- Low latency CEF data feeds

- Distribution of index information (f.e. DAX, STOXX)

- Reference data (PROPRIS, WSS)

Deutsche Börse Group

Headquartered in Frankfurt/Main, Deutsche Börse Group is one of the largest exchange organisations worldwide. It operates markets that provide integrity, transparency and security for investors wishing to invest capital and for issuers wishing to raise capital. On these markets, institutional traders buy and sell shares, derivatives and other financial instruments in accordance with clear rules and under strict supervision.

Deutsche Börse Group is now more than just a trading venue or exchange – it is a provider of financial market infrastructure. Its products and services span the entire finance value chain – its business areas range from pre-IPO services and the admission of securities, through trading, clearing, settlement and custody of securities and other financial instruments to collateral management. It also offers IT services, indices and market data worldwide.